Despite ongoing economic uncertainty, the Houston housing market showed renewed momentum in March. Sales rebounded to their highest level since last summer, boosted by easing interest rates, moderating prices, and a growing supply of homes. As buyer activity increases, signs continue to point toward a more balanced—and in some areas, buyer-friendly—market.

Key Highlights from the Houston Association of Realtors (HAR) March 2025 Market Update:

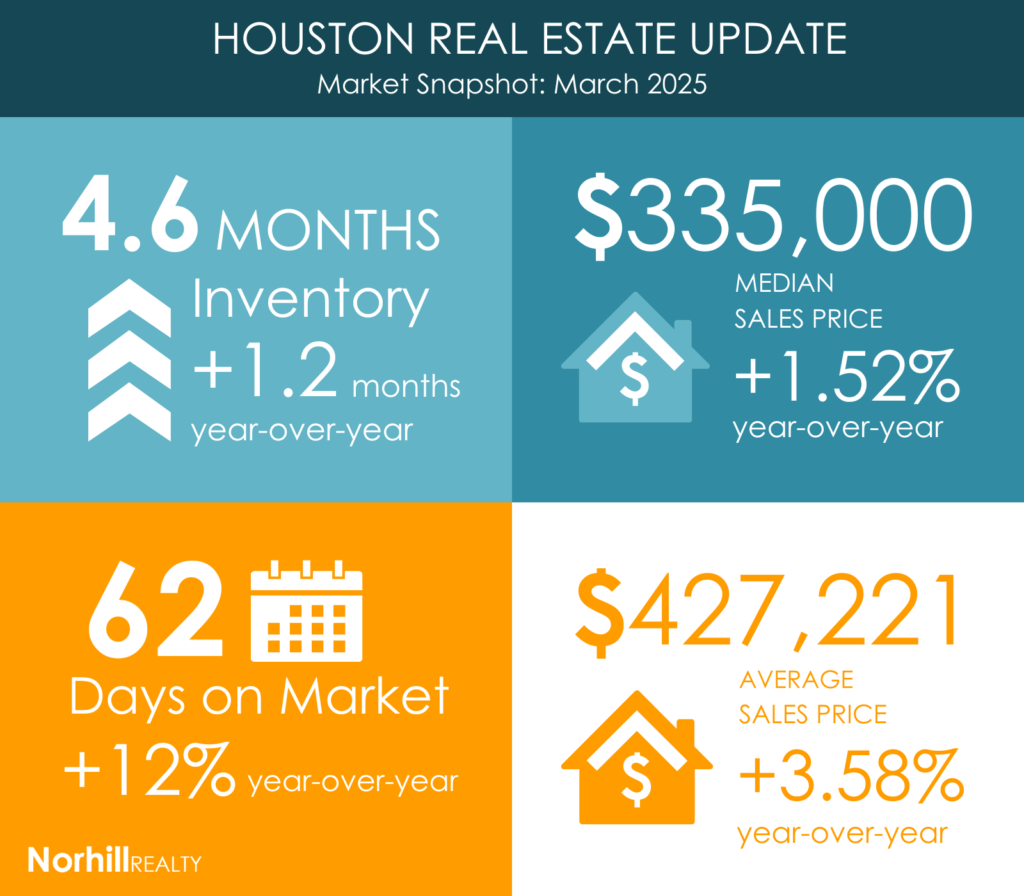

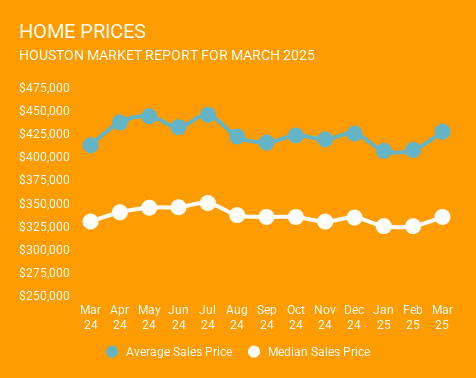

Home Prices: The median home price rose 1.5% to $335,000 year over year. The average home price increased 3.7% to $427,221. Price gains was primarily driven by strength in the luxury market, which remains very active.

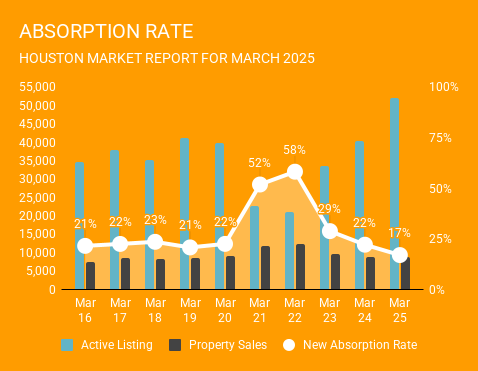

Likely to Sale: According to HAR, total active listings, or the total number of available properties, increased 29.3 percent to 51,997. March sales of all property types totaled 8,753 were relatively flat at-.09%. However, total single family homes sales performed much better, rising 2.6% in March.

As a result, the absorption rate, which is a measure of any given home’s likelihood to sell, for March 2024 was 17 percent. This is down from the absorption levels we saw in 2024, however slightly up from January and February of this year.

Market Segments: The luxury market ($1 million+) led all segments in March, with a 26.9% increase in sales compared to the same time last year. In contrast, homes priced under $100,000—which make up just 1% of the market—saw a 14.0% decline in transactions. All other price ranges recorded year-over-year sales growth.

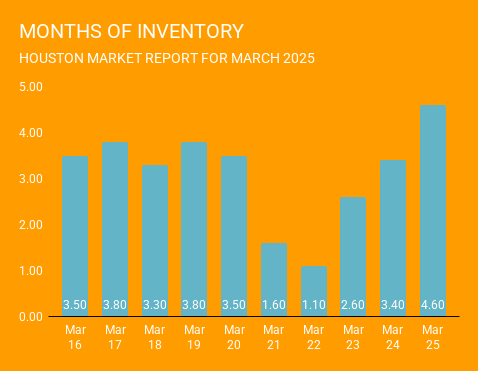

Inventory: Months of inventory increased to 4.6 months, up from 3.4 months in March 2024—a 12-year high. Housing inventory nationally stands at a 3.5-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply is generally considered a “balanced market” in which neither buyer nor seller has an advantage. The Houston market has moved much closer to a buyer’s market in several neighborhoods around town.

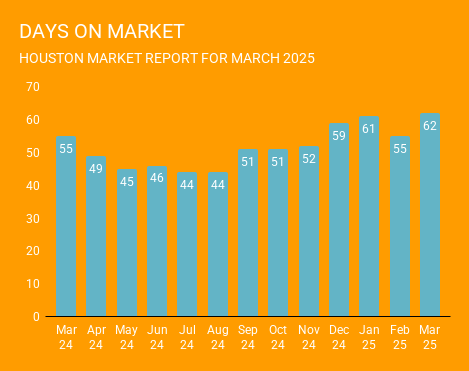

Days on Market:

Days on Market (DOM) rose from 55 to 62 days, reflecting a more measured pace of buyer activity.

Existing Home Sales:

- Existing single-family home sales rose 0.7% to 4,940 units.

- The average price increased 6.1% to $440,329, and the median price rose 3.6% to $335,000.

Townhouse/Condominium Trends:

Townhome and condo sales continued to lag behind 2024’s pace for the second month in a row.

- Sales declined 21.9%, with 397 units sold vs. 508 a year ago.

- Average price: ⬇ 1.5% to $272,144

- Median price: ⬇ 4.0% to $225,500

- Inventory surged to 6.9 months, the highest level since November 2011.

Looking Ahead

The Houston real estate market is heading into the spring season with strong fundamentals in place. Inventory is rising, providing buyers with more options and negotiating power—especially in a market that has been tight for several years. Demand remains strong in both the luxury and mid-range price points, creating a healthier, more balanced environment for both buyers and sellers.

While recent tariff news has introduced some uncertainty in national markets, Houston’s economy continues to outperform many other metros, thanks to its diverse industries and steady job growth. For buyers, this means entering a market with strong long-term potential.

Even with inventory on the rise, home prices—particularly in the $750,000+ segment—are expected to continue climbing. For motivated buyers, now may be a good time to lock in a purchase before prices push higher later in the year.

For sellers, the right timing to list your home will depend on your specific neighborhood. Many areas across Houston, especially those near town neighborhoods, are still seeing homes sell quickly and at prices above 2024 levels.

If you’re considering selling—or just want a clearer picture of your home’s current market value—or if you’re ready to begin your home search, click here to connect with a local agent who can guide you through the process.

📬 Want monthly updates like this in your inbox? Fill out the form below to subscribe to our market reports.

SIGN UP FOR OUR MONTHLY NEWSLETTER

Oops! We could not locate your form.